Student Loans

Student Loan Providers

August 16, 2018Student Loan Debt

Each year, we receive so many inquiries from students who are unable to close the financial aid gap with federal student loans offered by their college and need to identify private sources of student loans to close the gap. While we advise students to seriously consider their college choice in light of their financial aid gap, we have developed this posting to some of the private student loan providers for students who remain committed to their current college choice, not matter the cost.

We are providing a reprint of Mark P. Cussen’s posting of “Top Student Loan Providers.” We are not providing an endorsement of any of the student loan providers listed on this page. We advise students to carefully and thoughtfully research each student loan provider; understand the terms and costs associated with each loan; and whether their loans can be forgiven or if they are entitled to any discounts or rebates.

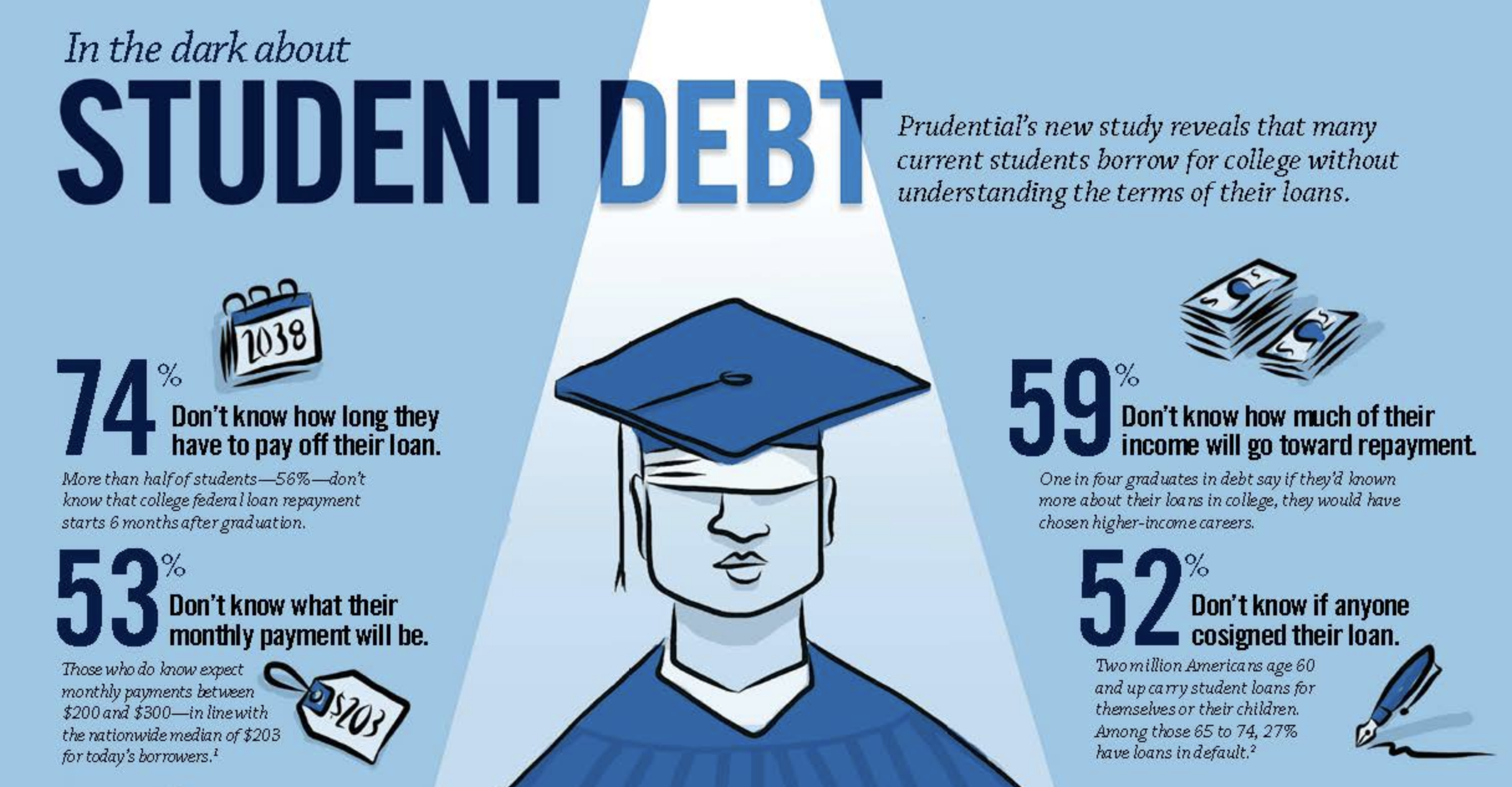

Before you borrow, read these important reports:

- SallieMae: 2017 How America Pays for College

- Student Loan Debt: Implications on Financial and Emotional Wellness

Top Student Loan Providers

By Mark P. Cussen, CFP®, CMFC, AFC | Updated June 20, 2018 — 3:15 PM EDT

Many students who borrow to pay for college make their way into the real world after graduation worried about being able to pay off their education loans. One of the best ways students and parents can minimize their loan obligations is to shop around for the best providers before they borrow. Although there is no definitive list of best loan providers, this article shows you those that have received accolades from consumers and financial-aid websites.

Where to Get Student Loans for College

The Federal Government

Any list of top student loan providers has to begin with Uncle Sam. Federally-subsidized student loans are often the cheapest – and in many cases, the only – alternative for lower or middle-income students and families who need to pay for college.

Pell Grants and subsidized loans offer rates and repayment terms that are typically far superior to anything found in the private sector, including deferment, forbearance and loan forgiveness programs.

For more information on federal student loan programs, visit www.studentloans.gov. The site is loaded with information and resources, such as how to obtain aid, and a calculator for estimating loan repayment.

Sallie Mae

At first, Sallie Mae (SLM) was a government-sponsored enterprise, but now operates as a publicly-traded corporation. Sallie Mae primarily offers private student loans for undergrads, graduates and parents. In 2004, it spun off a new company named Navient (NAVI) to handle the servicing of government-backed loans. They even offer family education loans for expenses associated with private school costs from kindergarten through high school.

Its website offers information, products, and tools on saving, planning, and paying for college. Sallie Mae has been rated A+ by the Better Business Bureau, as well.

Nelnet

This provider is geared toward private loans for college students and tuition payment plans for thousands of K-12 schools. Nelnet (NNI) offers customers educational services in loan servicing, payment processing, education planning, and asset management. Their website is loaded with tools and resources that help borrowers determine where they are financially and how to choose the best loan.

Some of their available tools include budget sheets, guidance on how to prevent identity theft and education on general money management. It also provides answers to a comprehensive list of FAQs and offers both email and telephone customer service support.

StudentLoan.com

StudentLoan.com differs from Sallie Mae in that it is owned and operated by Discover Bank (DFS). It was previously owned by Citibank until 2010. Student loans are just one of the many financial products and services offered by this company best known for issuing consumer credit cards. There are no loan application, origination or late fees required.

The site offers comprehensive educational tools, articles and calculators for students and parents, and it provides a variety of payment options. One advantage offered by Discover Student Loans is that school-certified college costs up to 100% can be covered. They also offer loan consolidation.

Citizens Bank

Although it does not have a standalone website devoted to student loans, Citizens Bank’s (CFG) student loan webpage easily allows you to apply for a student loan. They offer private loans for students and parents at both the undergraduate and graduate levels. There are a variety of payment options available and customers who also open a student checking account can get a rate discount on their student loan.

Social Finance (SoFi)

This unique company provides younger borrowers who lack the financial credentials typically required by banks and other traditional lenders with a viable alternative for their student loans. SoFi was the first to refinance both federal and private loans, and its underwriters consider such non-standard factors as professional merit and work history in addition to the borrower’s credit profile. Fixed and variable rate notes are available in multiple terms with no origination or application fees, and no prepayment penalties.

LendKey

This consolidation provider was created when hundreds of nonprofit credit unions united to establish this site. LendKey provides loans for undergrads, consolidations for college graduates, and refinancings of parent PLUS loans. Borrowers need to be members of a credit union in order to be eligible for services. LendKey offers some of the lowest student loan rates available.

CommonBond

Founded in 2011, CommonBond is a lender that offers refinancing of graduate and undergraduate student loans. They also offer private student loans for undergraduates and non-MBA graduate students.

Wells Fargo

Wells Fargo (WFC) provides undergraduate, graduate, and consolidation services for private student loans while offering both fixed- and variable-rate loans. They award discounts for various incentives, such as graduation or opening another account with the bank.

SimpleTuition

This site, by Lending Tree offers access to a pool of consolidation lenders. Borrowers can compare rate estimates among lenders without having each of them pull their credit information. However, borrowers will have to submit to a credit check in order to be approved.

SimpleTuition offers tips, tools and deals to help students plan for the costs of college, and how they manage their student loans.

Cedar Education Lending

Although Cedar Education Lending offers student loans and consolidation loans, borrowers with very high loan balances or loans that charge high rates of interest may find a better alternative on this site. This site also offers loan consolidation that could result in longer repayment periods, and lower monthly payments, a wise move for borrowers whose earnings are expected to be low when they first get out of school.

SunTrust

SunTrust (STI) charges no origination, application, or prepayment fees and student loan borrowers can qualify for rate reductions and cosigner release options if they demonstrate financial responsibility. Prospective borrowers can apply for and compare fixed and variable rate loans online. It no longer offers a loan-consolidation program.

Student Loan Network

This group allows borrowers to compare lenders and also consolidate loans on its website. Borrowers can consolidate both private and governmental loans on the Student Loan Network, and gain access to educational materials about student loans and tips on how borrowers can avoid defaulting on them.

The Bottom Line

Students and parents who need financial assistance now have more options than ever before. Banks, credit unions and other lenders offer a vast array of loans and scholarships that can help to finance education costs in an affordable manner. For additional information on student loans, contact your school’s financial aid officer or a financial advisor.

Read more: Top Student Loan Providers | Investopedia https://www.investopedia.com/articles/personal-finance/082314/top-student-loan-providers.asp#ixzz5OMeSzdZE

Follow us: Investopedia on Facebook

Private Student Loans

April 24, 2018Need-based Financial Aid

January 18, 2018Need-based Financial Aid

Having worked with hundreds of students through our College Planning Cohort Program, and having reviewed hundreds of Financial Aid Award Letters, we have gained first-hand insight into the array of financial aid policies across the college admissions landscape. Students and parents typically believe that the EFC (Expected Family Contribution), as computed by the U.S. Department of Education, after processing a student’s FAFSA (Free Application for Federal Student Aid), is the amount that parents (or independent students) are required to pay toward the costs of attending college.

Many institutions will play on the naiveté of students and parents by providing intentionally misleading Financial Aid Award Letters, which suggest that students with ‘0’ or low EFCs will not pay anything toward their college costs. The most common practice involved in this deception is to list Federal Student Loans under the caption, ‘Awards,’ or using such language as, “We are pleased to offer.” while also failing to disclose the estimated Cost of Attendance.

As a result, students and parents assume thousands of dollars in student loan debt as a means of reaching their ‘0’ EFC. Any remaining financial aid gap is oftentimes closed with a combination of small scholarships such as, Achiever’s Scholarship, Trustee Scholarship, Dean’s Scholarship, etc., which are not renewable after the student’s first year. To register for second-year classes, students simply take out more student loan debt and the process continues year after year until students reach their federal student loan maximums, at which time, many students simply stop attending college.

So what does ‘Need-based’ financial aid really mean?

Need-based financial aid simply means that a college will assist in meeting a student’s full financial need, based on either the EFC, as generated by the FAFSA, or the financial need as determined by the CSS/Financial Aid Profile. However, the means through which a student’s financial need is met will vary widely from being met with generous need-based institutional scholarships and grants, to being met with thousands of dollars in student loans. In this regard, there are institutions that have ‘no-loan’ financial aid policies, where student loans are not considered as part of their financial aid formula, and other institutions where student loans represent the most significant part of their financial aid formula.

How do I identify the institutions that offer the most generous institutional scholarships and grants?

Go to the US News and World Reports college rankings and the colleges with the most generous need-based financial aid policies are atop the rankings and among the most selective institutions to which a student can be offered admission. For example, Williams College is the top ranked liberal arts college in the United States and has the most generous financial aid policies that we have experienced through our students. Students with demonstrated financial need receive free books, assistance with their health insurance, transportation, and other unexpected costs associated with attending Williams College. Amherst College, the number two ranked liberal arts college is nearly as generous. Our students with demonstrated financial need have received institutional scholarship offers from Amherst College covering overing 94 percent of the $72,000 per year estimated Cost of Attendance (after application of the US Pell Grant).

Students and parents must carefully research colleges long prior to submitting applications if students are to position themselves for being offered admission to institutions with the most generous need-based financial aid policies. We have listed institutions, of which we are aware, with some of the most generous need-based and institutional scholarship programs:

Top liberal arts colleges: Williams, Amherst, Bowdoin, Swarthmore, Middlebury, Pomona, Carleton, Claremont McKenna, Davidson, Washington & Lee, Colby, Colgate University, Harvey Mudd, Smith, Vassar, Grinnell, Hamilton, Haverford, Wesleyan University, and Bates.

“Williams has one of the most generous financial aid programs in the country, thanks to generations of gifts from alumni, parents, and friends. It allows us to award more than $50 million a year in financial aid to more than half of all Williams students. Our financial aid program is based entirely on need, and we meet 100 percent of every student’s demonstrated need. We are committed to working with you and your family to make a Williams education affordable.”

“We aim to ensure high-achieving students from all backgrounds realize a Colby education is accessible regardless of their families’ means,” said Vice President and Dean of Admissions and Financial Aid Matt Proto. “Colby has many ways of expressing this commitment, most notably that we meet the full demonstrated need of admitted students using grants, not loans, in financial aid packages. This cost estimator is another tool for families to see that a Colby education is possible.”

The Ivy League: Brown, Columbia, Cornell, Dartmouth, Harvard, Princeton, University of Pennsylvania, and Yale.

“Princeton has a long history of admitting students without regard to their financial circumstances and, for more than a decade, has provided student grants and campus jobs — not student loans — to meet the full demonstrated financial need of all students offered admission.”

Top national universities: University of Chicago, MIT, Stanford, Duke, CalTech, Johns Hopkins, Northwestern, Rice, and Vanderbilt.

“Providing for college is one of the largest single investments a family will make, and we strongly believe that a Vanderbilt education is well worth the investment. Opportunity Vanderbiltreflects our belief that a world-renowned education should be accessible to all qualified students regardless of their economic circumstances.”

“We make three important commitments to U.S. Citizens and eligible non-citizens to ensure that students from many different economic circumstances can enroll at Vanderbilt. Vanderbilt will meet 100% of a family’s demonstrated financial need. Instead of offering need-based loans to undergraduate students, Vanderbilt offers additional grant assistance. This does not involve income bands or “cut-offs” that impact or limit eligibility.”

How many colleges should I apply to?

Because financial aid policies so widely vary by institution, the rule of thumb for students who qualify for need-based financial aid, is to apply to as many selective institutions as possible, to which the student is a strong candidate for admission, so that they student and their parents will have many financial aid award letters upon which to base their financial college choice.

The devastating impact of making the wrong college choice

Student Loan Assistance

June 11, 2014President Obama issued a Presidential Memorandum that will allow an additional 5 million borrowers with federal student loans to cap their monthly payments at just 10 percent of their income.

FACTSHEET: Making Student Loans More Affordable

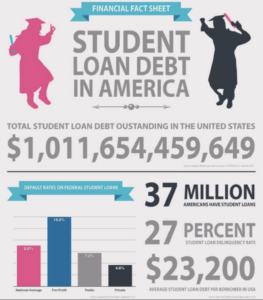

- 71 percent of those earning a bachelor’s degree graduate with debt, which averages $29,400.

- The Presidential Memorandum also outlines a series of new executive actions aimed to support federal student loan borrowers, especially for vulnerable borrowers who may be at greater risk of defaulting on their loans.

- The Secretary of Education has been directed to ensure that student loans remain affordable for all who borrowed federal direct loans as students by allowing them cap their payments at 10 percent of their monthly incomes. The Department will begin the process to amend its regulations this fall with a goal of making the new plan available to borrowers by December 2015.

- Most students taking out loans today can already cap their loan payments at 10 percent of their incomes. Monthly payments will be set on a sliding scale based upon income. Any remaining balance is forgiven after 20 years of payments, or 10 years for those in public service jobs.

- The Servicemember Civil Relief Act requires all lenders to cap interest rates on student loans – including federal student loans — at 6 percent for eligible servicemembers.

- The American Opportunity Tax Credit (AOTC) provides up to $2,500 to help pay for each year of college. But the process of claiming education tax credits like the AOTC can be complex for many students, including for the 9 million students who receive Pell Grants, and hundreds of millions of dollars of education credits go unclaimed each year. To help address this complexity, the Department of Treasury will release a fact sheet clarifying how Pell Grant recipients may claim the AOTC.

Click here for the complete fact sheet…